The rate of tax depends on the individual’s resident status, which is determined by the duration of his stay in the country as stipulated under Section 7 of the Income Tax …

Australian income tax system is the major source of revenues generation for the government.Income tax in Australia has been the major player, in collecting revenues from the taxpayers personal earnings, capital gains and business income.

Michigan Department of Treasury 4897 (Rev. 03-16) Attachment 10 2016 MICHIGAN Corporate Income Tax Data on Unitary Business Group Members Issued under authority of Public Act 38 of 2011.

FORMS amp REPORTS2016 NEW TAX ORDINANCE INFORMATION New starting in 2016 Mandatory Estimated Tax Payments Effective for tax years beginning on or after January 1, 2016, the payment of estimated taxes is mandatoryfor any taxpayer that expects to owe 200 or more for the tax year.

Income Tax forms:issued by the Income tax department government of India is available for download for free.

No income tax in Washington State Washington State does not have a personal or corporate income tax. However, persons that engage in business in Washington are subject to business and occupation and/or public utility tax.

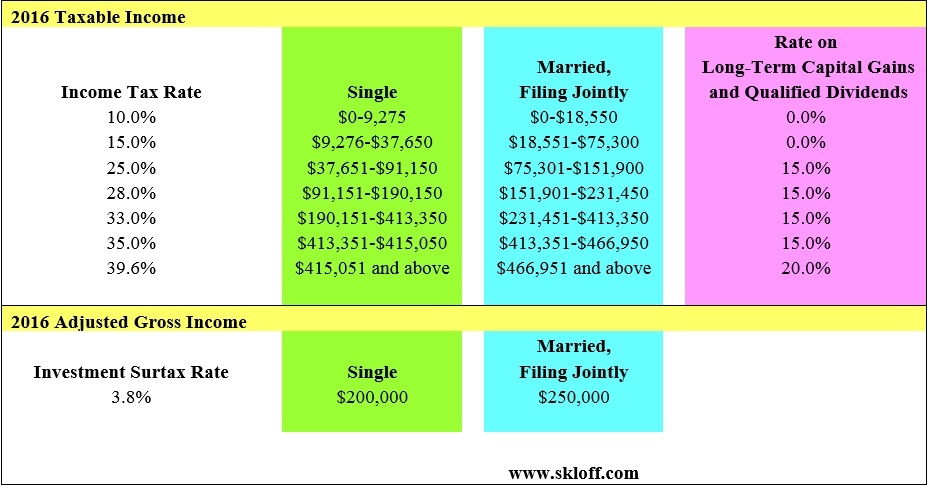

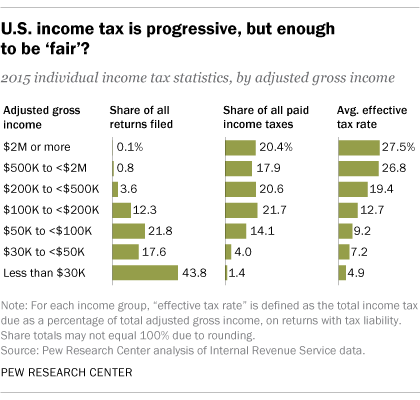

Income taxes in the United States are imposed by the federal, most state, and many local governments.The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions.

.jpg/250px-Effective_Federal_Excise_Tax_Rate_by_Income_Group_(2007).jpg)

Learn how to file your income tax return, make a payment, and more.

Income Tax Calculator – Know your income tax slab, tax breakers without bothering how to calculate income tax. Step by step calculation of your income at …

Filing requirements, forms, rates, laws, and other Idaho business income tax information